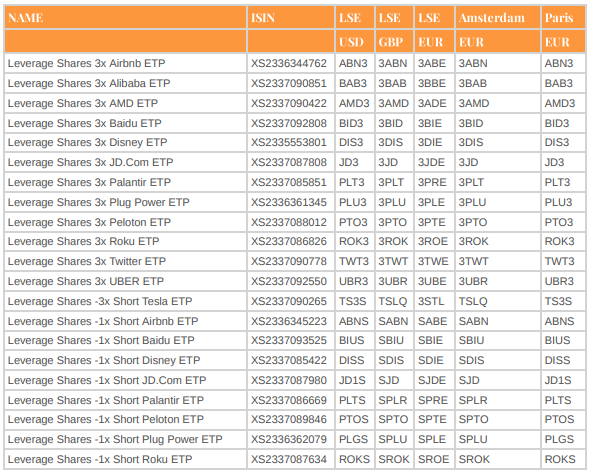

Leverage Shares, the pioneer of physically-backed single stock ETPs, is expanding its suite of Short and Leveraged (S&L) ETPs. The innovative provider is listing the first-ever leveraged ETPs offering 3x geared and -1x inverse exposure on Airbnb, Disney, Palantir, Peloton and a -3x inverse version of their flagship Tesla ETPs.

The launch of these ETPs offers investors analytics via some of today’s most innovative companies, and access to sectors like:

- streaming services;

- personal health;

- leisure.

These short and leveraged ETPs provide a cost-efficient alternative to those who want excellent exposure. Indeed, Leverage Shares has also added new stocks on which it now offers exchange-traded products. These include:

- Airbnb;

- Baidu;

- Dinsey;

- JD.com

- Palantir;

- Peloton;

- Plug Power:

- Roku.

“We’re known for listening to our investors and our latest batch of products proves just that – we are giving sophisticated traders additional instruments to include in their toolbox. Experienced investors can express strong convictions though our 3x ETPs or minimize downside risk by hedging with our inverse products”

Oktay Kavrak, Product Strategy, Leverage Shares

Moreover, Leverage Shares is adding 21 more names to its industry-leading array of S&L ETPs on single stocks.

“We are very pleased that Leverage Shares chose to partner with us to launch their new family of ETPs based on the iSTOXX Single-Stock Leveraged Indices. We see strong demand in the market for expressing high-conviction investment ideas, and these indices enable investors to do so in a way that is rules-based and transparent.”

Brian Rosenberg, Chief Revenue Officer, Qontigo

The 21-strong line-up offers exposure to leading US and Asian stocks at a fraction of the price.

- ISA/SIPP eligible;

- Listed at just $5 a share;

- No Margin Account Needed;

- Available in GBP, USD and EUR;

- Each ETP is 100% physically backed;

- Listed on London Stock Exchange, Euronext Amsterdam and Paris.