Investing can be a powerful tool for building wealth, whether you’re a seasoned investor or just starting. However, it’s easy to fall into certain traps that can undermine your financial goals. By being aware of everyday mistakes investors make, you can steer clear of them and keep your investment journey on track. This article outlines the most prevalent investing errors and offers strategies to avoid them,

Table of Contents

The most common investing mistakes to avoid

1. Not defining clear investment goals

One of the biggest mistakes investors make is not having clear investment goals. Whether you’re saving for retirement, a child’s education, or a major purchase, your goals should shape your investment strategy. Without clear objectives, you risk making haphazard decisions that don’t align with your long-term needs.

2. Failing to diversify your portfolio

A cardinal rule in investing is diversification. Many investors, particularly those new to the game, make the mistake of concentrating their investments in a single stock, sector, or even a geographic region. This approach might seem attractive, especially when certain markets or stocks are booming.

However, it exposes investors to higher risk levels. A single downturn in that sector or company can significantly impact the entire investment. Diversification means spreading your investments across a variety of asset classes, industries, and regions. This approach not only minimizes the risk associated with market volatility but also positions your portfolio to capture growth across a broader range of sectors

3. Chasing past performance

Just because an investment has performed well in the past doesn’t guarantee future success. Many investors make the mistake of chasing after stocks or funds that have recently performed well, thinking this trend will continue.

However, past performance is not a reliable indicator of future results, as market dynamics are constantly changing. A better approach involves focusing on long-term investment strategies that align with your financial goals and risk tolerance. To comprehend the factors influencing a stock’s performance, in-depth investigation and analysis are crucial.

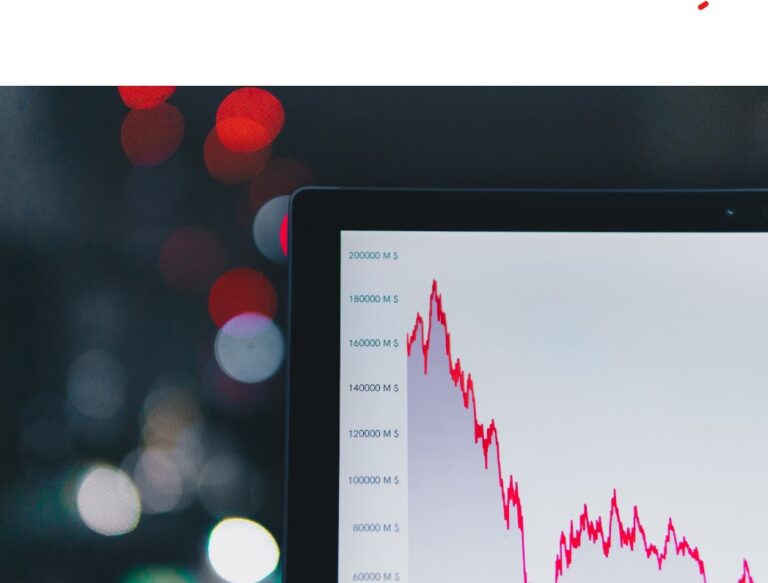

4. Reacting to market volatility

It’s no news that the market is inherently volatile, and knee-jerk reactions to short-term market fluctuations can harm your investment portfolio in an unredeemable way if care is not taken.

Therefore Selling off assets during a market downturn locks in losses, rather than riding out the volatility for potential long-term gains. Keeping a long-term outlook is key to successful investing.

5. Neglecting to regularly review your portfolio

Your investment needs and the market environment change over time. Therefore, failing to regularly review and adjust your portfolio can lead to an imbalance in your investment strategy. Rebalance your portfolio periodically to ensure it aligns with your current goals and risk tolerance.

6. Neglecting asset allocation

Asset allocation which refers to the process of distributing your investments among different asset categories like stocks, bonds, and cash – is crucial. Your allocation should reflect your investment horizon and risk tolerance. As these factors change, so should your asset allocation, requiring periodic rebalancing to maintain the desired risk level.

7. Falling prey to emotional investing

Emotions can be an investor’s worst enemy. Fear and greed often lead to poor decision-making, like panic selling or excessively risky bets. Adopting a disciplined investment approach, based on research and a sound strategy, helps mitigate emotional responses.

8. Ignoring tax implications

Taxes can significantly impact investment returns. Understanding the tax consequences of your investment decisions, such as the benefits of tax-efficient funds or the timing of buying and selling assets, is vital. Consider consulting a tax advisor to optimize your investment strategy for tax efficiency.

9. Setting unrealistic expectations

Many investors have unrealistic expectations about market returns, often underestimating the time and patience required to achieve significant gains. Realistic expectations, aligned with historical market performance and personal financial goals, are essential for long-term investing success.

10. Overconfidence in personal ability

Overconfidence can be a significant hindrance in the investment world. Some investors overestimate their ability to beat the market or time their trades perfectly. Recognizing the limits of one’s knowledge and expertise is crucial. Relying on professional advice or automated investment services can sometimes be a more prudent approach.

11. Underestimating the importance of research

Investment decisions should always be backed by thorough research. Skipping this crucial step can lead to ill-informed choices. Investors should take the time to understand the financial health, market position, and growth potential of any investment. This research helps in making informed decisions that align with one’s investment strategy.

12. Not learning from mistakes

Even the most experienced investors make mistakes. What sets successful investors apart is their ability to learn from these mistakes and avoid repeating them. Reflect on your missteps and use them as learning opportunities.

Let your mind be on continuous learning

Investing is a journey filled with potential missteps, each offering valuable lessons. Understanding and avoiding these common pitfalls will significantly enhance your success prospects. Therefore, you must approach investing with a mindset focused on continuous learning, patience, and discipline.

You should also know that Investing isn’t just about generating profits; it’s about making smart decisions that align with your financial goals and risk tolerance. As you traverse the market’s complexities, keep these lessons at the forefront to develop a strong and enduring investment portfolio.